BUSINESS FUNDING SOLUTIONS

At Clear Trac Solutions, we help entrepreneurs access the capital they need to start, grow, and scale their businesses—without confusion, unnecessary delays, or false promises. Whether you’re launching a startup or expanding an established company, our funding strategies are designed to work with your business goals,

not against them.

We guide you step-by-step through funding options that fit your situation, helping you secure the right capital while protecting your long-term financial health.

WHO BUSINESS FUNDING IS FOR

Our business funding solutions are ideal for:

Startups and new business owners

Small and medium-sized businesses

Entrepreneurs needing working capital

Business owners with limited or

challenged credit

Companies looking to expand, hire, or purchase equipment

Business owners tired of bank denials and unclear requirements

If you’re serious about growth, Clear Trac Solutions helps you get funded the right way.

TYPES OF FUNDING WE HELP

YOU ACCESS

We don’t believe in one-size-fits-all funding. We evaluate your business profile and match you with funding options such as:

BUSINESS LINES

OF CREDIT

Flexible funding you can draw from as needed—only pay interest on what you use.

BUSINESS

TERM LOANS

Structured loans with predictable payments for major investments

and expansion.

STARTUP & NEW BUSINESS FUNDING

Yes, funding is possible—even without years in business. We help position your business correctly.

Personal

Term Loan

Short-term funding to manage cash flow, payroll, inventory, and

daily operations.

0% Interest

Credit Cards

Finance vehicles, machinery, technology, and equipment essential to your operations.

SBA

Loans

Leverage personal or business credit responsibly to access higher funding limits.

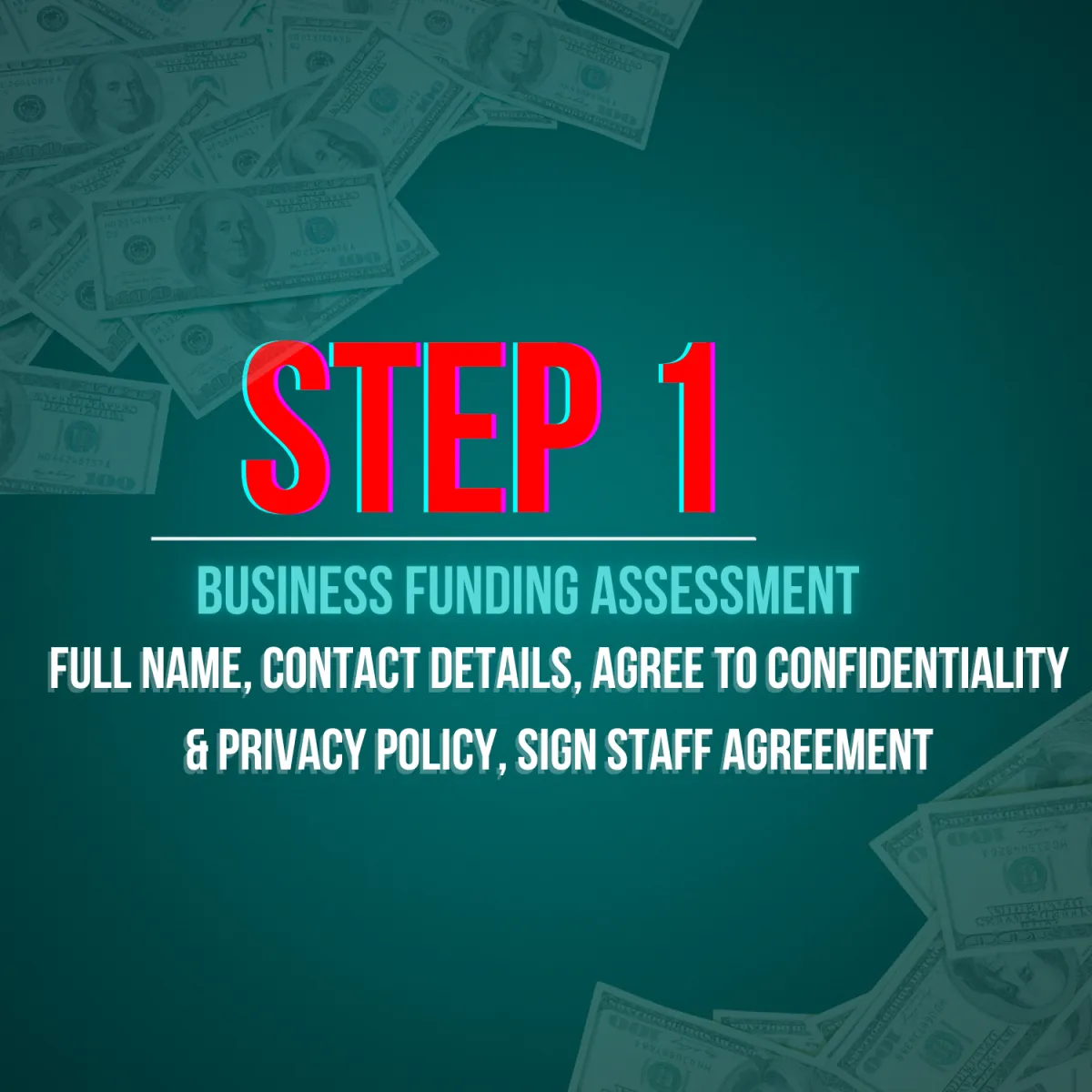

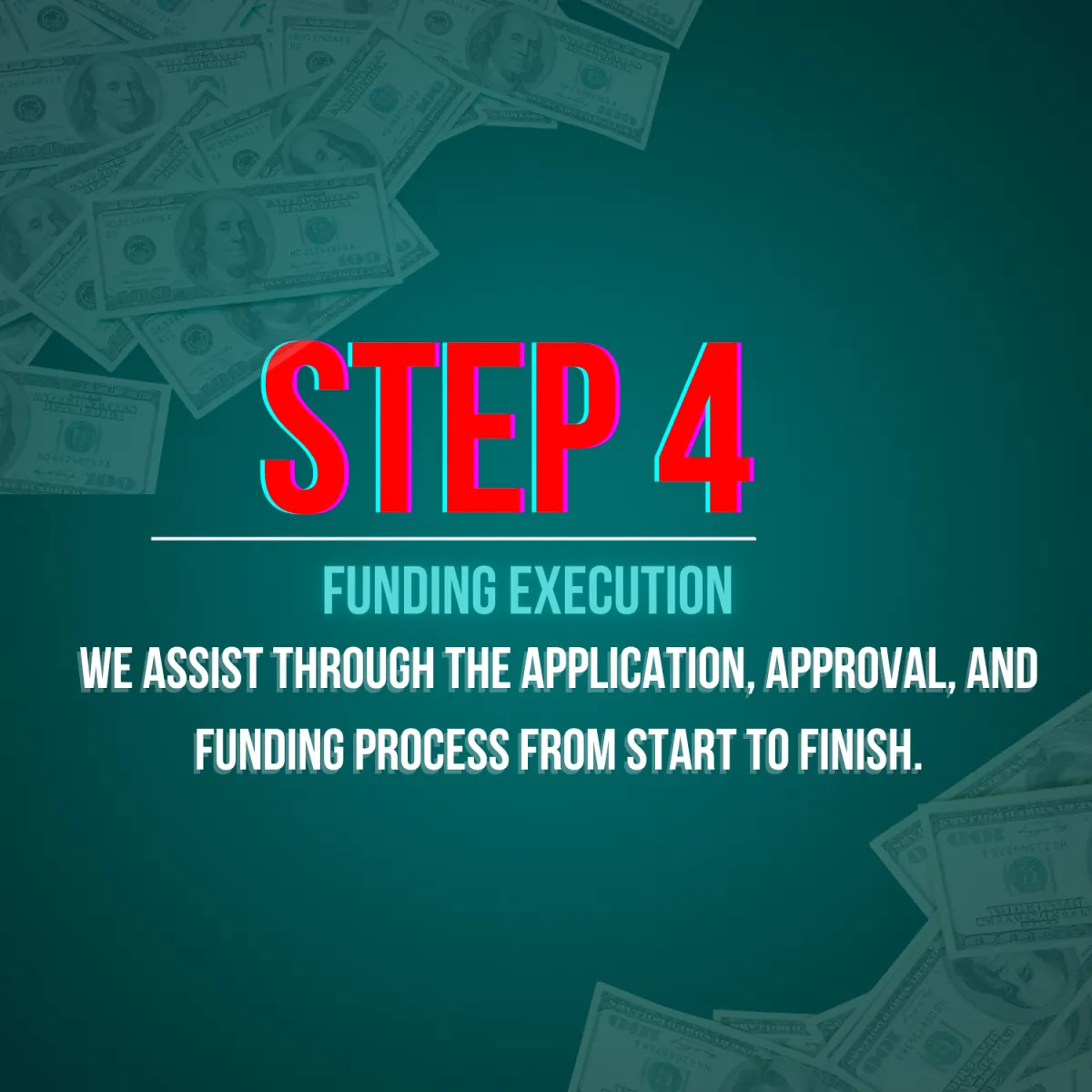

OUR FUNDING PROCESS

We keep the process clear, strategic, and stress-free.